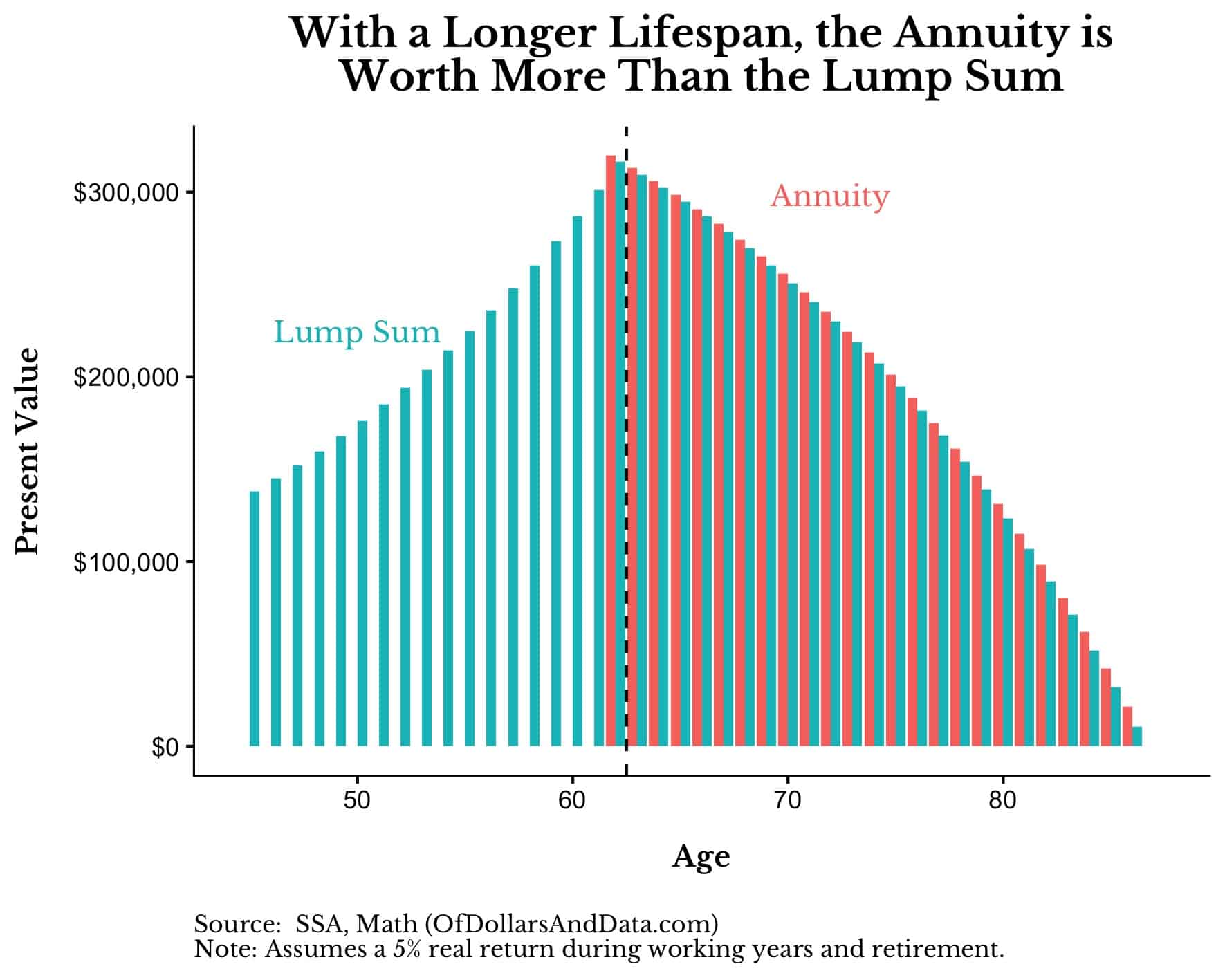

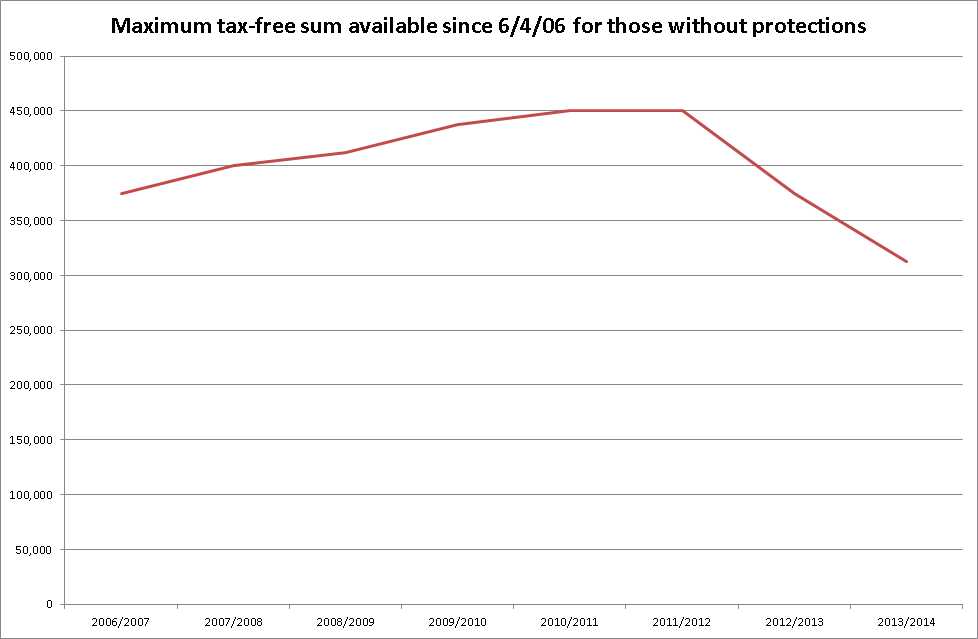

For example, if an employer assumes that its DB plan assets will return 7.5 percent in future years, the current lump-sum interest rate of approximately 5.0 to 5.5 percent represents an annual opportunity cost of 200 to 250 basis points. If the rate of return in the future on the assets disbursed in a lump-sum window would have exceeded the interest rate used to determine the lump sums, the plan will have lost an opportunity to benefit fully from those returns (“opportunity cost”). In deciding whether to offer a lump-sum window, a plan sponsor might wish to consider how it would affect its own and plan economics, including the impact on the following: The level of investment sophistication of the plan’s terminated vested participants might be another factor in the decision to open a lump-sum window, given that individuals who are confident in their ability to invest are most likely to welcome a lump-sum window. One type of plan sponsor that might benefit from this particular de-risking strategy is a company with a pension plan obligation that represents a significant percentage of the company’s net worth or market capitalization. Simply put, volatility surrounding a smaller financial obligation is better than volatility surrounding a larger financial obligation. Because the size of the DB plan will shrink in terms of assets and liabilities, the dollar impact of any future negative events, such as severe investment losses, will be reduced.Because liabilities will be transferred through the lump sums to participants who accept the offer, the plan will bear no future investment risk, interest-rate risk or longevity risk for those transferred liabilities.This alignment should reduce the incremental cost of a lump-sum window and temper the overall impact on a plan’s contribution requirements and balance sheet.Ī lump-sum window can help to de-risk a pension plan in two ways: These rates are similar to the rates used by employers for plan funding and expense calculations, which means that the value of a lump-sum distribution will be aligned better with its corresponding liability on a funding basis and an accounting basis. Beginning with the 2012 plan year, however, the amount of a lump-sum payment is based solely on corporate bond rates. Shortly afterward, General Motors said it plans to offer 42,000 salaried retirees and beneficiaries the choice of taking one lump sum in lieu of monthly pension checks.īefore 2012, a lump-sum window generally would have carried with it considerable incremental cost because of the legally required basis for calculating lump-sum payments, which included Treasury bond rates as well as corporate bond rates. salaried retirees and former employees as part of its efforts to de-risk its U.S.

announced it will offer a lump-sum window to about 90,000 U.S.

Moreover, an employer can choose to limit the size of the group to which it offers a lump-sum window, subject to applicable nondiscrimination rules.įor example, in April 2012 Ford Motor Co. While DB plan sponsors can offer lump sums as a standard option, offering lump sums only as a one-time window benefit avoids creating a protected right to the lump-sum option in the future and might produce a higher acceptance rate than an option that is a permanent plan feature. A participant who elects a lump sum receives a single payment instead of monthly pension checks. Rather, lump sums can be provided only as an optional form of payment that is offered with an alternative annuity payable at the same time, and that can be elected only with spousal consent if the participant is married.

One such “de-risking” strategy consists of transferring risk from the plan to current terminated vested participants by offering a lump-sum window.īy law, a plan cannot require a terminated participant to take a distribution as a lump sum if the amount of the lump sum exceeds a certain threshold. Lately, sponsors of DB plans have been exploring options for mitigating those risks. Defined benefit (DB) pension plans are subject to unexpected changes in plan financing as a result of three primary factors: investment performance, interest-rate movements and increases in participant longevity.

0 kommentar(er)

0 kommentar(er)